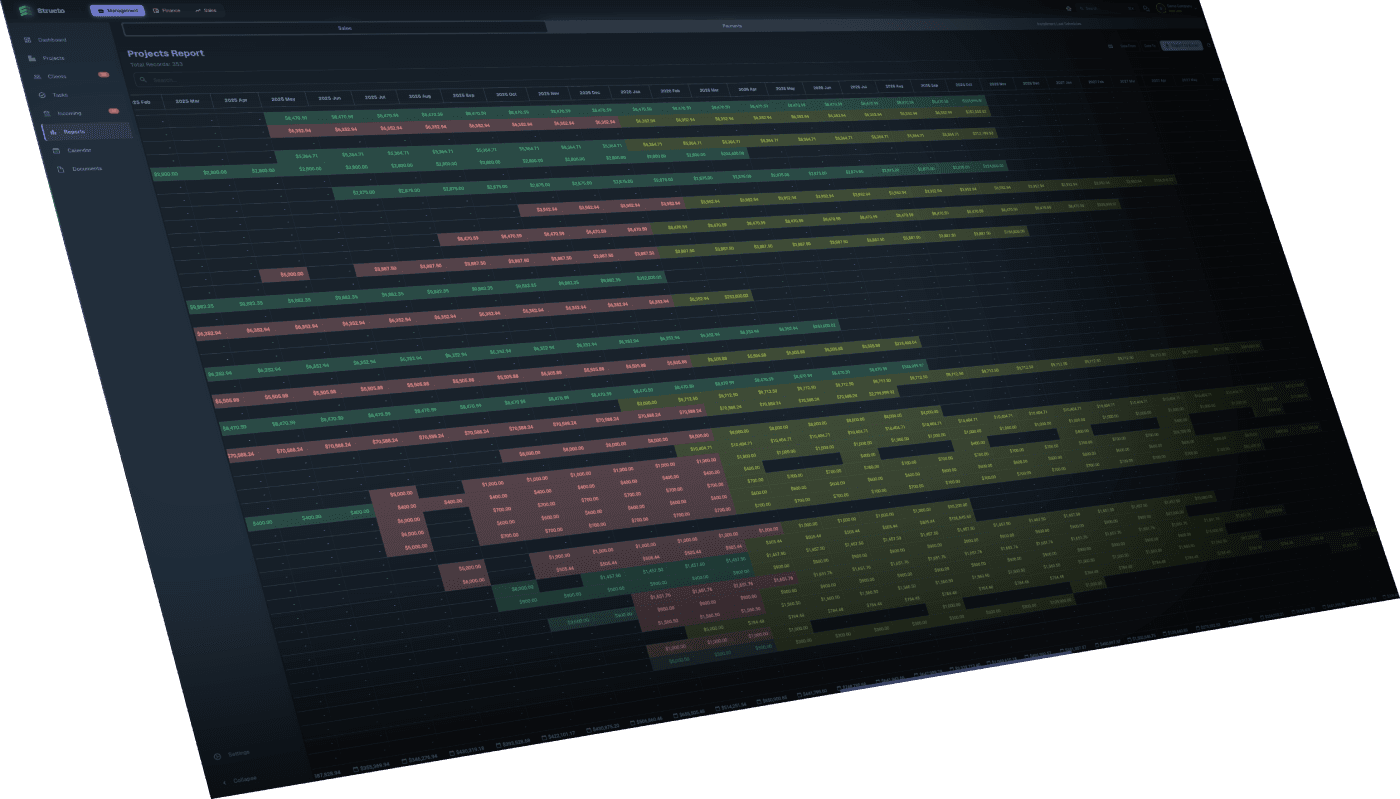

Bank-Grade Reporting.

From Dashboard to Due Diligence in Seconds.

Bank-Grade Reporting. From Dashboard to Due Diligence in Seconds.

Your internal dashboards show you the live picture. This module generates the formal, standardized reports your partner banks require to approve financing, audits, and mortgages.

Prove Your Portfolio’s Value.

Banks need to see the stability of your sales before issuing credit lines. This report converts your live sales data into a formal asset statement.

Audit-Ready: A standardized list of all active contracts and receivables, formatted specifically for banking officers.

Validation: Instantly demonstrate the total value of your sold inventory and confirmed incoming receivables.

Prove Your Portfolio’s Value.

Banks need to see the stability of your sales before issuing credit lines. This report converts your live sales data into a formal asset statement.

Audit-Ready: A standardized list of all active contracts and receivables, formatted specifically for banking officers.

Validation: Instantly demonstrate the total value of your sold inventory and confirmed incoming receivables.

Prove Your Portfolio’s Value.

Banks need to see the stability of your sales before issuing credit lines. This report converts your live sales data into a formal asset statement.

Audit-Ready: A standardized list of all active contracts and receivables, formatted specifically for banking officers.

Validation: Instantly demonstrate the total value of your sold inventory and confirmed incoming receivables.

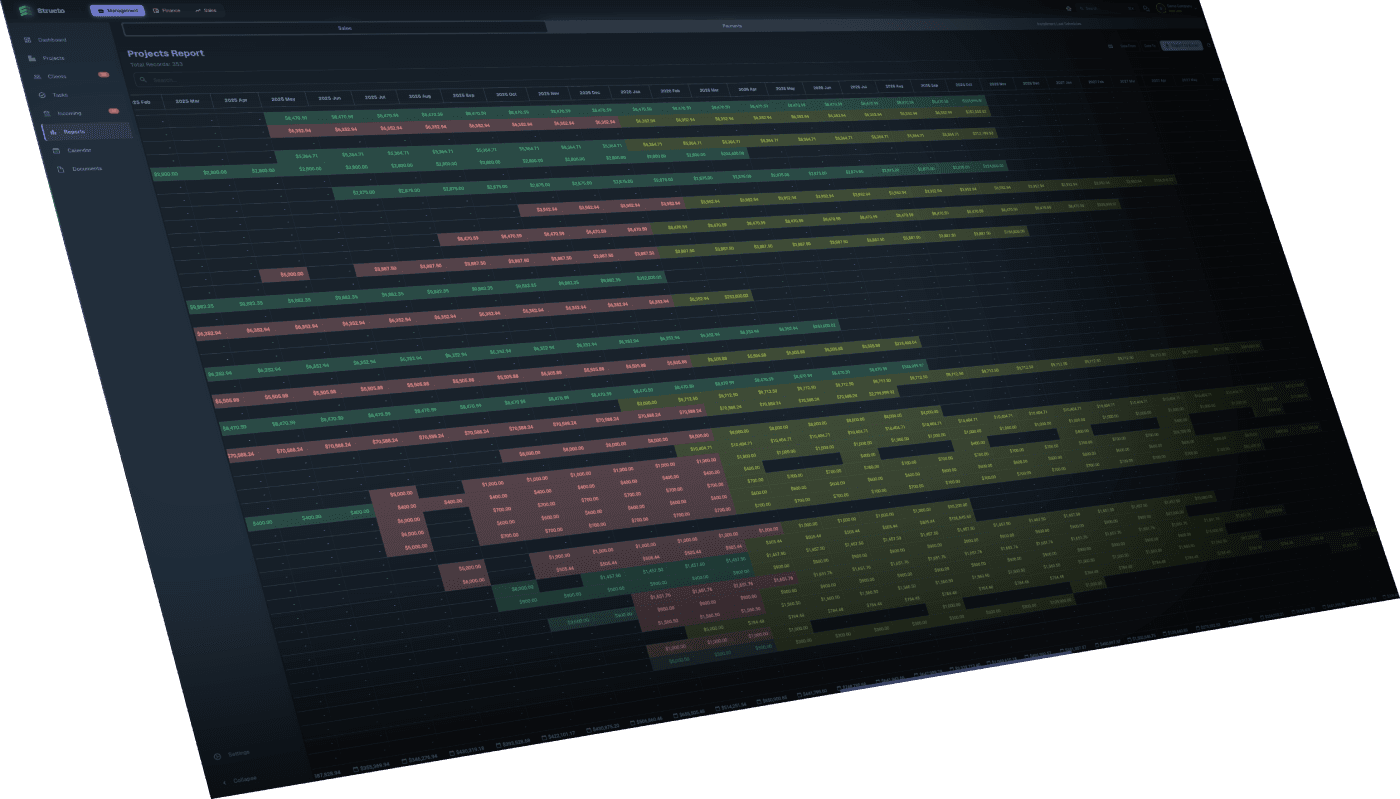

Transparent Cash Flow History.

When banks analyze your turnover, Excel spreadsheets raise questions. Structo’s automated logs build trust and eliminate currency disputes.

NBG-Synced: Every transaction is recorded with the official National Bank exchange rate (GEL to USD), eliminating questions during audits.

Traceability: A verified, immutable history of every payment, showing exactly how debt was covered.

Transparent Cash Flow History.

When banks analyze your turnover, Excel spreadsheets raise questions. Structo’s automated logs build trust and eliminate currency disputes.

NBG-Synced: Every transaction is recorded with the official National Bank exchange rate (GEL to USD), eliminating questions during audits.

Traceability: A verified, immutable history of every payment, showing exactly how debt was covered.

Transparent Cash Flow History.

When banks analyze your turnover, Excel spreadsheets raise questions. Structo’s automated logs build trust and eliminate currency disputes.

NBG-Synced: Every transaction is recorded with the official National Bank exchange rate (GEL to USD), eliminating questions during audits.

Traceability: A verified, immutable history of every payment, showing exactly how debt was covered.

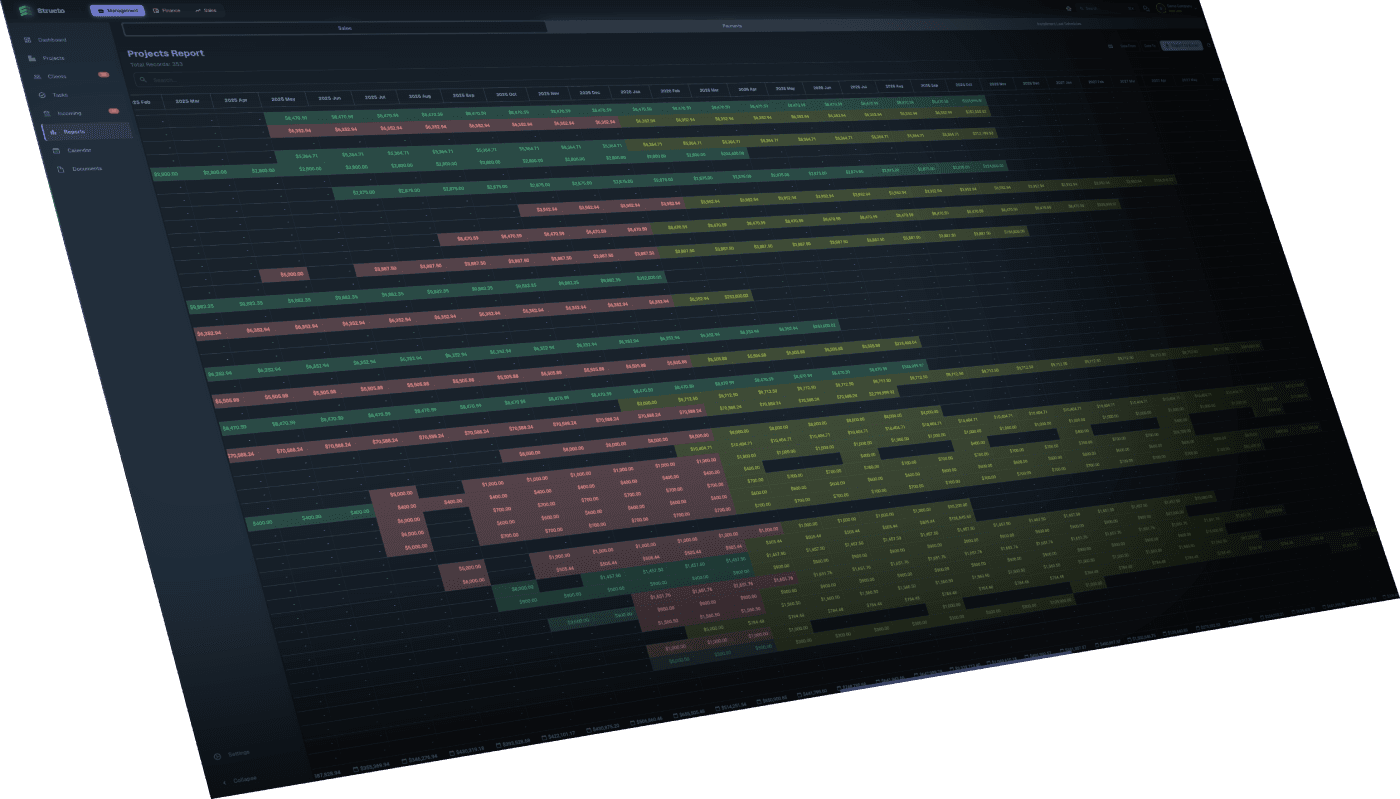

Automate Mortgage Approvals.

This is the most valuable report for your partner bank. Instead of waiting for clients to apply individually, hand the bank a ready-made pipeline.

Proactive Feed: Send the bank a generated list of clients whose internal installments are ending, complete with accurate final balances.

Faster Closing: Speed up the mortgage issuance process by providing verified data directly from the source.

Automate Mortgage Approvals.

This is the most valuable report for your partner bank. Instead of waiting for clients to apply individually, hand the bank a ready-made pipeline.

Proactive Feed: Send the bank a generated list of clients whose internal installments are ending, complete with accurate final balances.

Faster Closing: Speed up the mortgage issuance process by providing verified data directly from the source.

Automate Mortgage Approvals.

This is the most valuable report for your partner bank. Instead of waiting for clients to apply individually, hand the bank a ready-made pipeline.

Proactive Feed: Send the bank a generated list of clients whose internal installments are ending, complete with accurate final balances.

Faster Closing: Speed up the mortgage issuance process by providing verified data directly from the source.

Audit Ready

Standardized formats accepted by financial institutions and auditors.

Audit Ready

Standardized formats accepted by financial institutions and auditors.

Audit Ready

Standardized formats accepted by financial institutions and auditors.

NBG Integration

Automated currency conversion based on official National Bank rates.

NBG Integration

Automated currency conversion based on official National Bank rates.

NBG Integration

Automated currency conversion based on official National Bank rates.

Mortgage Pipeline

Generates ready-to-process lists for bank loan officers.

Mortgage Pipeline

Generates ready-to-process lists for bank loan officers.

Mortgage Pipeline

Generates ready-to-process lists for bank loan officers.

Zero Error

Eliminates manual Excel errors that can delay funding approvals.

Zero Error

Eliminates manual Excel errors that can delay funding approvals.

Zero Error

Eliminates manual Excel errors that can delay funding approvals.

One-Click Export

Download complex financial data in seconds for external sharing.

One-Click Export

Download complex financial data in seconds for external sharing.

One-Click Export

Download complex financial data in seconds for external sharing.

Transparency

Full drill-down history for every cent collected.

Transparency

Full drill-down history for every cent collected.

Transparency

Full drill-down history for every cent collected.

Use Cases

For the CEO

"Generating a Sales Report to prove confirmed receivables during negotiations for a new construction credit line."

For the CFO

"Using the Payment Flow logs to pass an annual financial audit without answering questions about exchange rate differences."

For the Sales Director

"Exporting the Final Payment Schedule to the partner bank to initiate mortgage processing for 50 clients at once."